Lifestyle and Target-Date Funds

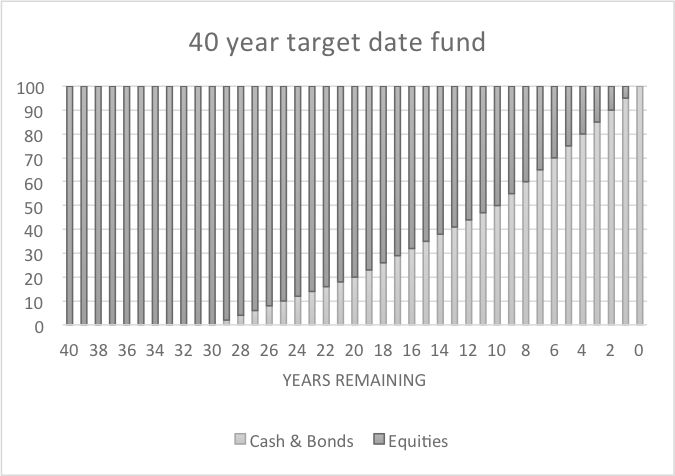

Lifestyle and target-date funds shift their investment profile as you move towards your selected investment end date. They start off with a higher allocation of equity investments such as shares and then move part or all of the fund to cash and bonds as they approach their target date.

This is great if you are likely to purchase an annuity at retirement or need the cash at the end of a fixed term but may be a bad choice if you are likely to leave the savings invested.

Historically, most savers approaching retirement would purchase an annuity. This requires the pension pot to be in cash. If you have thirty years to invest it is likely that a high level of equity exposure (investing in company shares) will be a sensible investment strategy. Many investors pick a fund on day one and do not revisit their choice until very close to retirement.

Inevitably, some retirees are very happy because when retirement looms the market is riding high and they are lucky to sell most of their holdings at the top of the market. Equally, for many not so lucky investors the market moves against them months, weeks or even days before they are due to sell and can often lead to a drop in their eventual retirement pot of 10-20% or sometimes worse. Clearly this is not ideal.

The principle of a lifestyle or target-date fund is that you pre-set an end date such as your expected retirement date or a key event such as your child entering university and invest with the date in mind. The manager of the fund knows what this end date is and will begin moving your investment into steadier, more predictable assets sometimes up to 30 years before your key date. Over the course of this extended period more and more of your investment will be moved to these more predictable assets so that when you retire or need the money for a special event, you are not shocked by a sudden market movement.

These types of funds can be excellent for many investors although with the recent pension changes allowing much greater flexibility over how you draw down from your pension savings they may be less suitable for many pension savers than previously.

We can help you decide whether this type of product is right for you and select a suitable provider.

Financial Advice... pure and simple

Chase Smythe 25 Ltd provides financial advice and planning, in plain English, to people who want to ensure they make the right financial decisions at the right time and at the right cost. It's simple!